The Valour Group development at 301 Westmount in Kitchener remains on schedule for completion in April 2024 and will provide 85 residential suites complete with amenity spaces

and 12,000 sq. ft. of ground-floor commercial space.

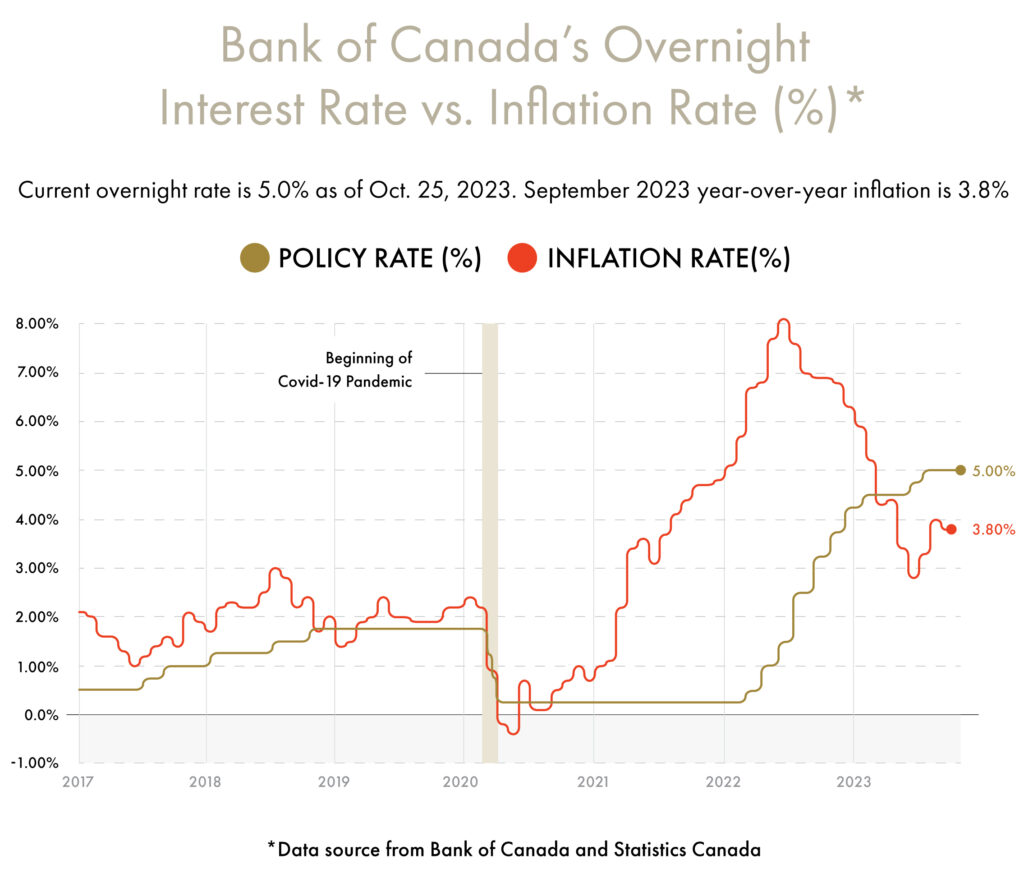

In the midst of the fall season’s colourful transformation, the Canadian real estate market forges ahead, offering buyers and sellers some stability. In September, the national average home price in Canada experienced a 1% increase from the prior month and is up 2% from last year. This stability in pricing can be partially attributed to the Bank of Canada maintaining policy interest rates at 5% over the past few months.

In September, 37,685 homes were sold in Canada, representing an 8.0% increase when compared to last year. Canada’s MLS benchmark price, which represents the standard price of a Canadian house, stood at $741,000. Notably, Canada’s sales-to-new-listings ratio (SNLR) reached 51% in the month of September. A SNLR of above 60% represents a seller’s market and a SNLR of less than 40% represents a buyer’s market. While the market is mostly in balance, in some regions it slightly favours sellers over buyers.

Real Estate Market

The Canadian real estate market has had some significant adjustments. In September, there was a modest increase of 6.3% in newly listed properties compared to the previous month. The MLS Home Price Index decreased by 0.3% compared to the previous month but has increased by 1.1% when comparing it to last year. Additionally, the actual national average sale price saw a 2.5% rise compared to last year. As a result of the interest rate increases this summer, national home sales in September declined by 1.9% compared to August.

The introduction of bill C-56, also known as the Affordable Housing and Groceries act, on September 21, 2023, is expected to have a significant impact on the Canadian real estate market. This legislation will effectively raise the GST Rental Rebate from 36 percent to 100 percent and would eliminate the current GST on rental construction nationwide. The main objective of this bill is to provide affordable rental units to Canadians by stimulating the development of additional apartment buildings, student housing and senior residences.

In addition to the introduction of bill C-56, the Ontario Government announced the complete removal of the 8.0% HST on new rental housing developments on November 1st. The removal of the HST is an initiative by the Ontario Government aimed at further encouraging the development of rental construction projects, making them more economically viable while simultaneously providing more affordable housing for Ontarians. Projects eligible for the HST removal must have a minimum of four units or ten private rooms, and must commence construction between September 14, 2023, and December 31, 2030, with construction completed no later than December 31, 2035.

While positive activity in the supply for real estate was displayed in the month of June, with a 5.9% month-over-month increase, a perpetually decreasing supply of construction labour and increasing month-over-month sales signifies a tighter real estate supply and a positive trend in real estate market transactions through to the latter half of the year.

Canadian Economy

The Canadian labour market experienced minimal change in September. After falling in August, the employment rate showed a modest 0.1% increase in September. Similarly, the unemployment rate which had risen by 0.5% to a total of 5.4% in August, declined by 0.2% in September to an unemployment rate of 5.2%. The small changes witnessed in the employment and unemployment rates show a current stability within the labour market.

Immigration continues to play a key role in supporting the Canadian economy. Due to Canada’s significant aging population, Canada has been increasing its immigration targets for the past 30 years to help support economic growth. Canada’s target for new permanent residents (PRs) in 2023 is 465,000, with many of these new PRs being economic immigrants intended to help boost Canada’s economy. Currently, Canada’s immigration stands at 1.2% and at this rate, Canada accepts three times as many immigrants per capita as the United States of America.

Inflation and Monetary Policy

On October 25th, the Bank of Canada announced its decision to continue to hold interest rates steady at 5%, as it had done previously over the past two months. Additionally, the bank of Canada hinted at the possibility of future increases should inflation persist. This announcement came in the wake of the Consumer Price Index’s decline, which fell from 4.0% in August to 3.8% in September, signalling a slowdown in growth. As we transition into the fall season, our team is committed to closely monitoring the market to provide valuable insights to our investors and essential stakeholders.